What Is Bitcoin? Value, use and prospects of 'digital gold'

Table of Contents

Bitcoin (BTC) is a revolutionary digital currency that has transformed the way we perceive and interact with money. Introduced in 2009 by an anonymous creator or group of creators under the pseudonym Satoshi Nakamoto, Bitcoin operates as a decentralized digital currency without the need for a central authority, such as a government or financial institution. This article delves into the fundamentals of Bitcoin and its underlying technology.

What Gives Bitcoin Value?

Bitcoin’s value comes from two key factors that work together: its functionality and its growing network. These two aspects strengthen each other, making Bitcoin increasingly valuable over time.

How Functionality and Networks Work Together

The more people use a network, the more useful it becomes. For example, a telephone network with only a few users has limited value. But when you can call anyone, the network becomes far more valuable. The same is true for monetary systems like Bitcoin.

Why Networks Are Important in Money

Throughout history, people have used many things as money, from shells to bottle caps. Gold, however, has stood out as the most reliable form of money. Its value comes from three main traits: scarcity, durability, and divisibility. These qualities made gold an ideal way to store and exchange value. Over time, its usefulness created a global "gold network," making it a widely accepted form of money. For centuries, gold was the standard for accounting and reserves. While the U.S. dollar has largely replaced it, gold still holds significant value today.

Bitcoin as a Modern Version of Gold

Bitcoin shares many of the same traits as gold, making it a digital alternative for storing value. One of its key advantages is its limited supply. Only 21 million bitcoins will ever exist, making it much rarer than many other forms of money, including paper currency or historical options like shells or salt. This scarcity helps Bitcoin retain its value over time, unlike currencies that can lose purchasing power due to inflation.

Bitcoin is also highly divisible. A single bitcoin can be divided into 100 million smaller units called satoshis. This means that no matter how valuable a bitcoin becomes, it can always be used for smaller transactions. In contrast, a U.S. dollar can only be divided into 100 cents.

Another important feature is Bitcoin’s durability. Like the internet, Bitcoin is supported by a global network of computers. These systems work together to track ownership and ensure the security of every bitcoin in existence. This decentralized structure makes Bitcoin resilient and long-lasting.

Advantages Over Gold

Bitcoin offers additional benefits that gold cannot match. One of these is portability. You can send any amount of Bitcoin to anyone in the world within minutes, making it much easier to transfer than physical gold.

Another advantage is verification. Checking the authenticity of Bitcoin is straightforward and almost impossible to fake, unlike gold, which requires special tools and expertise to confirm its purity.

Finally, Bitcoin benefits from the power of the internet. Although it was introduced in 2009 and is much younger than gold, its adoption has grown rapidly. Over 100 million people now own Bitcoin, while gold ownership has remained largely unchanged. If Bitcoin’s network continues to expand and reaches the same level of acceptance as gold, its value could increase significantly. Some estimates suggest that each bitcoin could eventually be worth around $500,000 if it matches gold’s market capitalization.

Bitcoin combines the strengths of traditional money like gold with modern advantages, making it a unique and powerful form of digital currency.

Understanding Bitcoin

Who Controls Bitcoin?

You might wonder, "Where did Bitcoin come from, and how are its rules decided?"

Bitcoin is governed by an open-source protocol that was originally created by its pseudonymous founder, Satoshi Nakamoto. This software is freely available to anyone in the world, and since Bitcoin’s launch in 2009, thousands of people have contributed to its development. The individuals who voluntarily run this software form the Bitcoin network.

While the Bitcoin protocol can evolve over time, its changes are not decided by a single entity or small group. Instead, decisions are influenced by a much larger community. This community includes millions of Bitcoin holders, businesses that use Bitcoin, developers working on the technology, and anyone else who interacts with or relies on Bitcoin. Together, this diverse group plays a role in defining what Bitcoin is and shaping its future.

What Makes Bitcoin Unique?

Bitcoin is fundamentally different from traditional currencies and payment systems. Its distinguishing features include:

- Decentralization: Unlike fiat currencies controlled by central banks, Bitcoin operates on a decentralized network called the blockchain. Thus, when dealing with Bitcoin, you don't need intermediary organizations, unlike traditional finance.

- Limited Supply: Bitcoin's total supply is capped at 21 million coins, making it a deflationary asset.

- Transparency: All Bitcoin transactions are recorded on a public ledger, ensuring transparency and immutability.

- Peer-to-Peer Transactions: Bitcoin allows direct transfers between users without intermediaries, reducing costs and increasing speed.

Key Terms of the Bitcoin Network

Bitcoin operates on a blockchain, a distributed ledger technology that records all transactions across a network of computers. The key components of how Bitcoin works are:

- Blockchain: A chain of blocks containing transaction data, timestamps, and cryptographic hashes.

- Mining: The process of validating and adding new transactions to the blockchain through computational work.

- Wallets: Digital tools that store Bitcoin and allow users to send and receive funds.

- Keys: Each Bitcoin wallet has a private key (used for signing transactions) and a public key (shared for receiving funds).

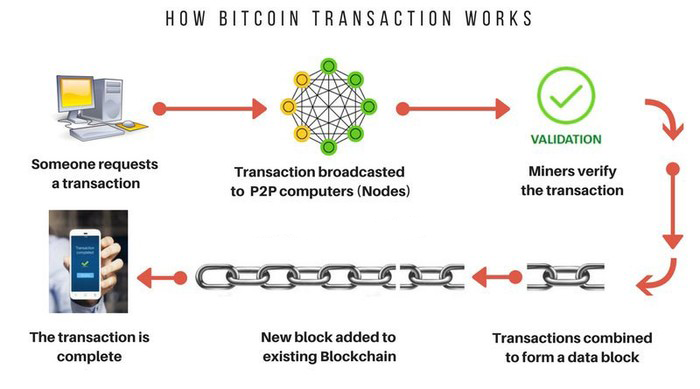

How Do Bitcoin Transactions Work?

Let’s take a closer look at how transactions happen within the Bitcoin network. In a traditional bank, all transactions between customer accounts are recorded as deposits and withdrawals, which update the account balances. The bank acts as a trusted third party or intermediary, maintaining this ledger.

Bitcoin also has a ledger, but it’s completely decentralized. Instead of being managed by a single authority like a bank, transactions in Bitcoin’s ledger are verified by a distributed network of “nodes.” Nodes are individuals who run Bitcoin software, and anyone can become a node without needing permission.

The Structure of Bitcoin’s Ledger

The Bitcoin ledger operates differently from traditional systems. It only allows new transactions to be added; existing data cannot be edited or deleted. This immutability is a key feature that makes it nearly impossible to alter the history of transactions recorded in the Bitcoin ledger.

New transactions are grouped into blocks, and each block is cryptographically linked to the previous one. This forms a continuous chain of blocks, or a "blockchain," creating a secure, tamper-proof record that traces all the way back to the first Bitcoin transaction.

Validating and Adding Transactions

Nodes in the Bitcoin network validate transactions to ensure they follow the rules of the system. These rules include checking that no one is spending more Bitcoin than they have, among other safeguards. Once a transaction is validated, nodes broadcast it to others in the network.

For a transaction to be officially added to the blockchain, nodes must reach a consensus on its validity. This is a complex process because the participants in the network don’t necessarily trust one another and may even try to deceive others about the transaction details. Achieving agreement among a group of strangers without mutual trust has historically been a challenging problem, which is why financial systems have always relied on trusted institutions like banks. Bitcoin is the first practical solution to this issue.

The Rules of the Bitcoin Network

Bitcoin operates according to a predefined set of rules that ensure the system runs smoothly. These rules include preventing users from overspending their balances and limiting the total number of bitcoins that can ever exist (21 million). Whenever a new transaction is proposed, nodes check whether it complies with these rules before it is shared with others and eventually added to the blockchain.

Reaching Consensus in a Decentralized Network

For a transaction to be included in the ledger, the nodes must collectively agree that it is valid. This process of agreement is known as consensus. In the world of cryptocurrencies, there are several methods for reaching consensus, but Bitcoin uses a system called Proof of Work (PoW).

Proof of Work is a mathematically enforced method for achieving consensus. It requires participants to prove they have completed a certain amount of computational work, which consumes energy. This requirement is crucial because it makes it prohibitively expensive for malicious actors to disrupt the system.

The Role of Miners in Bitcoin

The participants responsible for performing this computational work are called “miners.” Mining is the process of creating new bitcoins and is a key part of Bitcoin’s consensus mechanism. By solving complex mathematical problems, miners validate new blocks of transactions and add them to the blockchain. Mining also plays a vital role in securing the network, ensuring its integrity without relying on a centralized authority.

Through its decentralized structure and innovative use of Proof of Work, Bitcoin has created a system that enables secure, trustless transactions and maintains the integrity of its ledger without the need for traditional intermediaries like banks.

The Advantages of Bitcoin

Bitcoin offers several advantages over traditional financial systems:

1. Financial Inclusion

Bitcoin enables access to financial services for individuals who are unbanked or underbanked. With only an internet connection, anyone can participate in the Bitcoin network.

2. Security

Bitcoin transactions are secured using cryptographic techniques, making it nearly impossible to counterfeit or double-spend. Additionally, users have full control over their funds.

3. Low Transaction Costs

Compared to traditional banking systems and payment processors, Bitcoin transactions often incur lower fees, especially for international transfers.

4. Inflation Hedge

Bitcoin's fixed supply makes it an attractive hedge against inflation. Unlike fiat currencies that can be printed at will, Bitcoin's scarcity helps maintain its value over time.

Risks and Challenges

While Bitcoin has many advantages, it is not without risks and challenges. These include:

Volatility

Bitcoin is known for its price volatility, which can result in significant gains or losses for investors. This volatility stems from its speculative nature and relatively small market size.

Security Concerns

Although the Bitcoin network is highly secure, individual wallets can be vulnerable to hacking or phishing attacks if not properly protected. Private keys must be stored securely to prevent theft.

Regulatory Uncertainty

Bitcoin's legal status varies across countries. Some governments have embraced it, while others have imposed strict regulations or outright bans, creating uncertainty for users and businesses.

Environmental Impact

Bitcoin mining consumes a significant amount of energy due to its computationally intensive process. This has raised concerns about its environmental sustainability.

How to Use Bitcoin

Getting Started with Bitcoin

- Choose a Wallet: Choose a Bitcoin wallet to store your funds, such as our online BTC wallet. Options include hardware wallets, software wallets, and mobile wallets.

- Buy Bitcoin: Purchase Bitcoin from cryptocurrency exchanges, peer-to-peer platforms, or even Bitcoin ATMs.

- Secure Your Funds: Protect your private keys and enable additional security measures, such as two-factor authentication.

Using Bitcoin for Transactions

Bitcoin can be used for various purposes, such as:

- Purchases: Many merchants accept Bitcoin as payment for goods and services, including e-commerce platforms, restaurants, and travel companies.

- Remittances: Send money internationally with lower fees and faster processing times, especially to regions with limited access to traditional banking services.

- Investment: Hold Bitcoin as a long-term store of value or trade it for short-term gains on cryptocurrency exchanges.

- Charity: Many organizations accept Bitcoin donations, offering a transparent and efficient way to contribute to causes.

Can Bitcoin Be Stolen?

Bitcoin itself is secure, but individual wallets can be compromised if users do not take adequate precautions. Common risks include:

- Phishing Attacks: Fake websites or emails designed to steal private keys or credentials.

- Malware: Software that targets wallet files or private keys.

- Human Error: Losing access to private keys or falling for scams.

To minimize risks, always use reputable wallets, enable security features, and educate yourself on potential threats. Regularly backing up your wallet and using hardware wallets for significant holdings can also enhance security.

The Role of Bitcoin in the Economy

Decentralized Finance (DeFi)

Bitcoin plays a foundational role in the growing decentralized finance ecosystem. It enables trustless financial transactions and serves as collateral in various DeFi applications.

Hedge Against Economic Instability

In regions experiencing hyperinflation or political instability, Bitcoin has emerged as a safe haven asset. Its global accessibility and decentralized nature provide an alternative to unstable fiat currencies.

Innovation in Payments

Bitcoin has revolutionized cross-border payments by eliminating intermediaries and reducing transaction times. This innovation has the potential to streamline global trade and remittance flows.

The Future of Bitcoin

Institutional Adoption

Major companies and financial institutions are integrating Bitcoin into their operations, enhancing its legitimacy and accessibility. For example, some corporations hold Bitcoin as a reserve asset, while financial firms offer Bitcoin investment products.

Technological Advancements

Ongoing developments, such as the Lightning Network, aim to improve Bitcoin's scalability and transaction speeds, making it more practical for everyday use. Additionally, innovations in blockchain technology may address energy consumption concerns associated with mining.

Global Impact

Bitcoin has the potential to reshape the global financial system by promoting financial inclusion and reducing reliance on traditional banking systems. Its borderless nature empowers individuals in economically underserved regions to participate in the global economy.

Regulatory Evolution

As Bitcoin becomes more widespread, governments and regulatory bodies are developing frameworks to govern its use. Clearer regulations may foster greater adoption while ensuring consumer protection and market stability.

Conclusion

Bitcoin is a groundbreaking innovation that has changed the way we think about money and financial transactions. Its decentralized nature, transparency, and limited supply make it a valuable asset and a powerful tool for promoting financial independence. While it faces challenges such as volatility, regulatory uncertainty, and environmental concerns, its advantages and potential for future growth cannot be ignored. As Bitcoin continues to gain traction, it remains a key player in the ongoing evolution of the global financial landscape, offering a glimpse into a future where financial systems are more inclusive, efficient, and secure.